- New Pan Card Application Form 49a Word Formation

- New Pan Card Application Form 49a In Word Format Free Download

- New Pan Card Application Form 49a Word Format Download

- New Pan Card Application Form 49a Word Formatting

49A Application for Allotment of Permanent Account Number In the case of Indian Citizens/lndian Companies/Entities incorporated in India/ Unincorporated entities formed in India See Rule 114 To avoid mistake (s), please follow the accompanying instructions and examples before filling up the form Assessing officer (AO code).

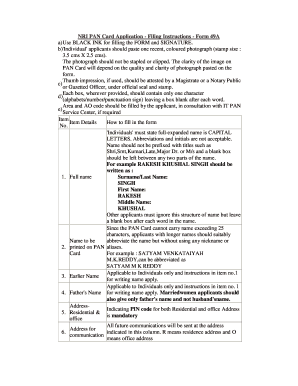

INSTRUCTIONS FOR FILLING FORM 49A (a) Form to be filled legibly in BLOCK LETTERS and preferably in BLACK INK. Form should be filled in English only (b) Each box, wherever provided, should contain only one character (alphabet /number / punctuation sign) leaving a blank box after each word. Thus, OCI Cardholders, PIO cardholders are all eligible to fill out Form 49AA, while NRIs holding an Indian passport can fill out Form 49A.Here are 12 simple steps for you to apply for an Indian PAN Card from abroadLog in to the PAN Card Website online here nsdl.comScroll down the page and click on the link that says “Apply for a new PAN card. The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through e-mail. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card, bank and other financial accounts.

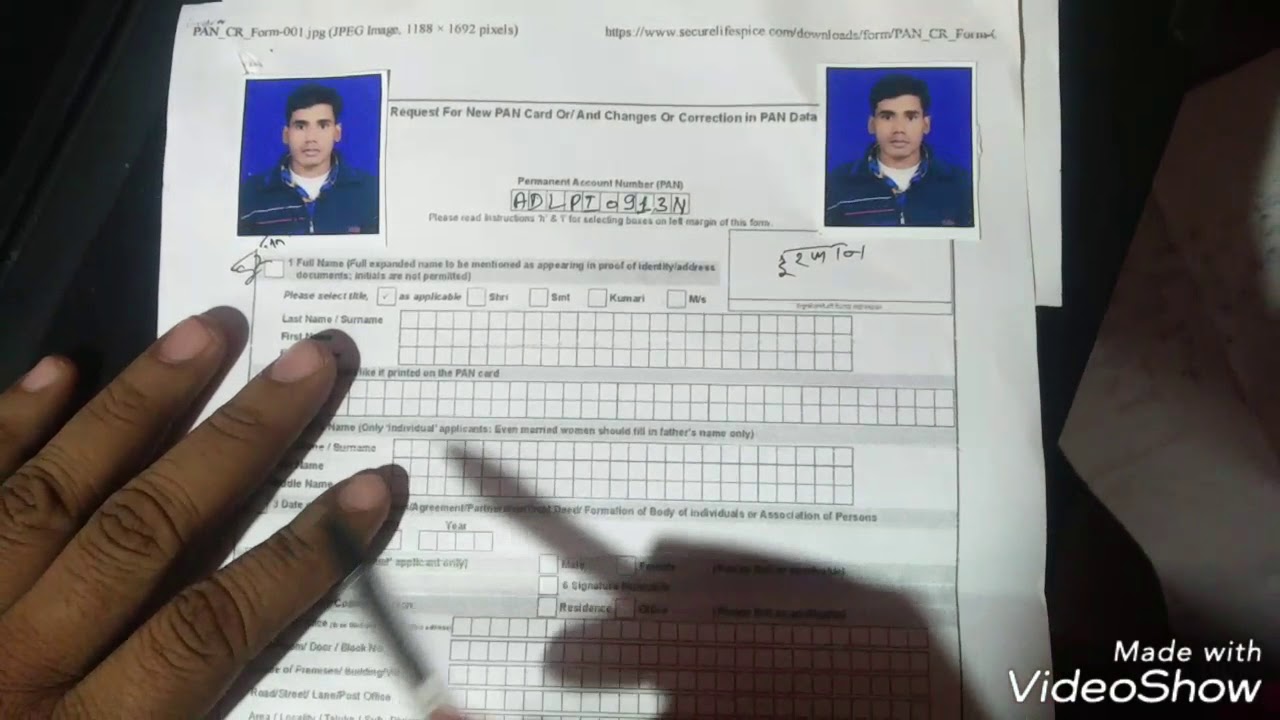

PAN CARD APPLICATION / PAN CARD CORRECTION FORM:

With effect from April 8, 2012, PAN Card Applications are required to be furnished in the new format. New “PAN Card Application Forms 49A / 49AA” have been prescribed by the Income Tax Department, as under

- Indian citizens who wish to apply for a new PAN Card can apply for one by submitting a duly filled and signed PAN Card Application Form 49A. Also this form is applicable for Allotment of Permanent Account Number in the case of Indian Companies, Entities incorporated in India, Unincorporated entities formed in India. New PAN Card Form 49A

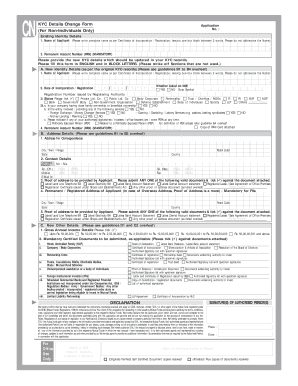

- Foreign citizens who wish to apply for a new PAN Card can apply for one by submitting a duly filled and signed PAN Card Application Form 49AA. However, a Qualified Foreign Investor PAN applicant should submit PAN Card Application Form 49AA after filling up the KYC details. Also this form is applicable for Allotment of Permanent Account Number in the case of entities incorporated outside India, unincorporated entities formed outside India, etc. New PAN Card Form 49AA

New Pan Card Application Form 49a Word Formation

Correction in PAN Details / Data or Request for Duplicate / Reprint of PAN Card

- In case of entities / individuals who have a PAN but do not have a PAN card and wish to get a duplicate / reprint of the PAN card, or wish to make changes to their existing PAN card may fill up the Change Request Application form. PAN Card Correction Form – For New PAN Card – Changes – Correction in PAN Data

Additional Guidelines for Filling PAN Card Application Form

KNOW STATUS OF YOUR PAN CARD APPLICATION FORM / TAN APPLICATION

For Updated Info. or / and Official Copies>> Please visit http://incometaxindia.gov.in or http://tin-nsdl.com

Permanent Account Number (PAN) is a ten-digit alphanumeric number. PAN enables the Income Tax Department to link all affairs / transactions of a person like payment of income/wealth tax , Tax deducted at source, Income Tax/Wealth Tax Returns, Bank Tranzactions etc.

New Pan Card Application Form 49a In Word Format Free Download

A typical PAN structure is like 'ABCPL1234K' . First three characters i.e. 'ABC' as in the above PAN are alphabetic series running from AAA to ZZZ. Fourth character of PAN i.e. 'P' in the above PAN represents the status of the PAN holder. 'P' stands for Individual, 'F' stands for Firm, 'C' stands for Company, 'H' stands for HUF, 'A' stands for AOP, 'T' stands for TRUST etc. Fifth character i.e. 'L' in the above PAN represents first character of the PAN holder's last name/surname. Next four characters i.e. '1234' are sequential number running from 0001 to 9999. Last character i.e. 'K' in the above PAN is an alphabetic check digit.

Section 139A of Income Tax Act, lays down who is required to apply for PAN and Rule 114B of Income Tax Rules lays down the transactions where PAN is required to be quoted. As required by section 139A. A Penalty of Rs. 10,000/- has been prescribed under section 272B for violating the above sections and rules.

CBDT has recently revised the format of form 49A to include document of Date of Birth (DoB). Also the list of document to be attached has also been revised. The revised version of ABCAUS Form 49A incorporates these changes and is latest and uptodate format. See CBDT Notification Click Here >>

ABCAUS excel based application for Permanent Account Number is very simple and user friendly. The user is required to fill the data in a pop up form and PAN Form in excel is updated automatically.

Users are not required to give blank spaces while filling the pop up form. If CAP lock is not on, it gives an alert message immediately. Dropdown list for various prefilled options have been provided to save the time of the user. Inbuilt check boxes also helps in selecting the various options in a very swift manner.

Inbuilt options have been given for checking Assessing Officer Codes and Complete list of various Business Codes have been provided in a Pop up Box. List documents to be attached can also be seen.

Macro should be enabled to use this form. Users are advised to read help file first.

Download ABCAUS Exccel PAN Form 49A Click Here >>

Download Help File Click Here >>

New Pan Card Application Form 49a Word Format Download